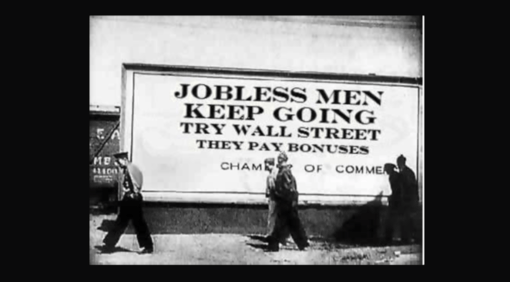

Photo by Mike Licht | CC BY 2.0

The answers are no and no. Even when the official unemployment rate is 4.1%, we are not close to real full employment. And it does not appear that inflation is about to surge. If the authorities are really worried about it, they should develop counter-measures that do not cause more unemployment.

How these issues have been handled over the last fifty years is instructive. In 1969, after a 1964 tax cut, and hefty spending increases for the Vietnam war and for social programs, prices were rising 5.5% a year. The official rate of unemployment was down to 3.5% and that lifted millions of people out of poverty. But there were millions more who were still unemployed or underemployed. Some of them people rioted in America’s cities. A special Department of Labor survey of ten inner-city communities revealed levels of unemployment that were much higher than those in the regular unemployment census.

In the late 60s and the 1970s, anti-inflation concerns often replaced anti-poverty and employment concerns. Reducing demand for goods and workers was used to limit wage and price increases. A short recession in 1969-1971 raised unemployment a bit but did not moderate inflation much. Then world demand pushed food prices up and oil prices surged. The latter was a long-term and major cause of higher inflation, but over time it seemed that wages got more blame than oil prices.

In 1971-1974 President Richard Nixon tried wage-and-price controls–an interesting idea that worked pretty well in World War II–but unionists felt that wages were more tightly controlled than prices; and business leaders did not like price controls. So a possibly useful method for maintaining job growth while restraining prices was dismissed. Then the administration and the Federal Reserve engineered a deep recession–the worst since the 30s. But textbook results did not follow. A new phenomenon was born: stagflation. Unemployment, which reached 8.5%, was supposed to limit wage and price increases, but it hardly made a dent. You’d have thought that this challenge to economic assumptions would cause experts to rethink the basics. If a recession with 8.5% unemployment did not have much effect on prices, perhaps the high-unemployment approach was wrong. But many experts doubled down on the old-time religion: if high unemployment did not tame inflation, then the economy needed more of it all the time. Not to worry. In the late 70s, former Nixon advisor, conservative economist Herbert Stein, wrote in the Wall Street Journal that people should simply consider that 7% unemployment was full employment. Guilt-problem solved.

In the early 80s, Federal Reserve Chair Paul Volcker and President Ronald Reagan gave America a shocking recession with very high unemployment. The White House also joined the war on unions and working-class living standards. This recession and some lucky events got inflation rates way down. Job totals grew strongly, but many jobs were lousy ones.

Economists, meanwhile, refined anti-worker inflation cures. A source here was conservative economist Milton Friedman’s 1960s idea of a Natural Rate of Unemployment, below which unemployment must never be allowed to go. This Natural Rate idea was supported by contrived ideas of how workers reasoned about jobs and inflation. In the 70s, Friedman’s idea began to morph into NAIRU, the Non-Accelerating Inflation Rate of Unemployment. The causative links between unemployment, wages, and prices were not always clear. But NAIRU was presented as a quasi-scientific way to determine how far down unemployment could go before wage-and-price inflation accelerated. While something like NAIRU seemed to work in the Reagan-Volcker recession, it did not have reliable predictive power. But it supplied scholarly sounding gobbledygook to justify the idea that workers had to bear the cost of inflation-fighting in the form of lost jobs and wrecked communities.

As cheap imports ballooned and union membership sagged, the official unemployment number could get pretty low (4% in 2000) without much increase in prices. But NAIRU lived on and was often equated with full employment. Quite a few economists learned to define full employment by reasoning backward from the level of unemployment they guessed was needed to keep the lid on wages, not forward by what was necessary to employ everyone who wanted a job. More economists grew skeptical of NAIRU, but in 2017-2018, the staffs at the Federal Reserve and the Congressional Budget Office seem to believe this: 4.7% unemployment = full employment = NAIRU. But the official unemployment rate was 4.1% in February of 2018–lower than NAIRU–but wages and prices are not taking off.

There are several reasons why 4.1% unemployment does not send wages and prices soaring. These reasons include falling union density and a flood of cheap foreign goods. But another reason is that real unemployment is much higher than 4.1%. There are millions of potential workers and quiet job-wanters who are ready to work but not counted as unemployed. The U.S. has a labor surplus, not a labor shortage. It’s true, for example, that in some locales, there aren’t enough truckers available at customary wage levels, so owners have to pay more. That’s good, but let’s not get too excited: $19.50 an hour and no company-supported health insurance is not exactly the lap of luxury, especially if you are making sizeable payments on your truck.

We need to reframe the conventional view of current labor markets. There is no general shortage of workers today. Labor markets are just getting to where they should be. Many workers are still paid rotten wages. It’s not a labor shortage when tens of millions of workers earn less and often much less than $20 an hour. There are millions of potential employees outside the labor force and ready to work. (There is some duplication among the following groups, but the total may be as high as ten million.) There are five million people every month who say they want a job although they are not currently looking for one. These people offer a variety of explanations for why they are not looking, including illness, family responsibilities, and the belief that they will not find a job; some of them eventually go to work.

Some of these 5 million are among the 7 million prime-age (25-54) males who are not working or even looking for work. Some of these men live in depressed areas in Chicago, Detroit, Cleveland, Paterson and Ocean City, New Jersey, rural areas of Alabama and Mississippi, West Virginia, East St. Louis, El Centro, California, and dozens of other left-behind communities. Some are disabled and some are drug addicts. But the number of disabled people in the labor force is rising and so is the number of prime-age men. There is, also, more demand for ex-prisoners–people who usually face huge barriers to getting hired. It is noteworthy too that the rate of employment for people without high-school diplomas is rising and that the percentage of people 55 and over who are in the labor force, which was 30% in 1993, is now 40%. These facts show that there is a large pool of labor that is not called unemployed but is virtually unemployed and ready to work.

As far as the big picture goes, we may want to labor shortages: there’s stronger demand for labor, but it’s a boohoo situation for employers who have to accept the kinds of workers they used to reject. How tragic for them. Or we can say that labor markets are just beginning to function as they should. And good times for workers have barely begun. Over the last year, after-inflation wages for average employees and for new hires have not moved.

Going forward, we should push for fuller employment–let’s start by aiming for 3.0% in the official count–and we want wages on the up escalator. We’ve not had 3.0% since World War II. Before we get there, will inflation fears cause the Fed to put the brakes on job growth? What should people do about inflation? If inflation rates are only modestly higher, and less than wage increases, we should pressure the authorities to leave things alone. If wages are increasing at 4 to 5% and prices at 2 to 3%, and consistently so, that’s a good deal for workers in the lower half. But what if prices surge? I don’t have the answer but I do have a suggestion. Some of the geniuses who run government and the economy should have their experts working on anti-inflation policies that don’t push millions of people into unemployment and poverty. If politicians really love workers–many say they do–why have they gifted corporations and rich people with trillions of dollars in 2001, 2003, and 2017–no obligation to create jobs or raise wages–but not approved a new WPA to provide good jobs for millions who still need them, or authorized a measly hundred million dollars for Institutes to Study Solutions to High Inflation That Don’t Require More Unemployment and Low Pay? Finally, why is the Fed threatening to turn NAIRU-ish, raising interest rates to slow job growth, when there is still a lot of underlying unemployment to solve?