The death of the 110-year old mining house Lonmin at a London shareholders meeting on May 28 occurred not through bankruptcy or nationalisation, as would have been logical at various points in time. It was the result of a takeover – generally understood as a rip-off of investors and workers – by an extremely jejune (7 year-old) South African corporation, Sibanye-Stillwater. The latter’s chief executive, Neil Froneman, is known for extreme aggression in both corporate takeovers and workplace cost-cutting, with by far the highest fatality rate in the mining industry.

In the spirit of the Lonmin-onomics looting skills pioneered by the firm’s notorious leader Tiny Rowland during the 1950s-80s transition from colonialism to neo-colonial neoliberalism, Froneman engineered the deal for a measly $383 million, and $460 million than South Africa’s Standard Bank estimated Lonmin’s worth. It was less than a mere tenth of a percent of Lonmin’s peak 2007 London Stock Exchange valuation.

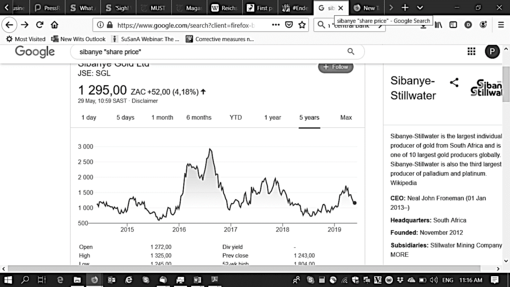

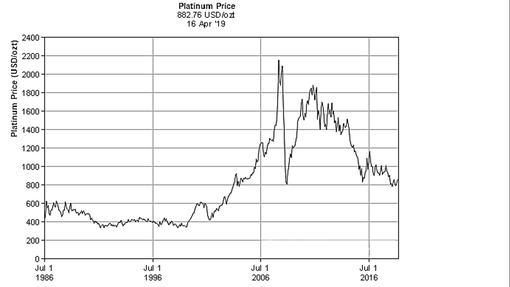

But through Froneman is celebrating and Sibanye’s shares soared by nearly 10% on May 28, the firm’s Johannesburg Stock Exchange price is still only 45% as high as it was in mid-2016. And the takeover did nothing to resolve underlying problems that caused Lonmin’s 2012 Marikana Massacre, and that have persisted ever since.

After all, Froneman “never left the learnings of Cecil Rhodes. He was groomed and brought up under those circumstances,” as his nemesis, trade union leader Joseph Mathunjwa vividly expressed it during a March 2019 mineworkers-v-Sibanye battle. Moreover, said Mathunjwa, “The State – Cyril Ramaphosa’s government – is helping Sibanye to break the strike. We have evidence of this. They have this toxic relationship as if they have never learnt anything from Marikana.”

Finance fuels the Resource Curse

One aspect of Marikana we must learn from is finance, especially as it appears from Lonmin’s autopsy to be a central cause of the firm’s demise. Relatively downplayed by analysts and activists so far, financial capital’s role at the site of the massacre – a dusty town and sprawling platinum-mining complex two hours drive northeast of Johannesburg – needs interrogation.

As dissected below, London mining capital’s self-destructive greed was exacerbated by the roles of Marikana microfinance, Washington ‘development finance’ – deserving scare-quotes for reasons that will soon be obvious – and Johannesburg-London corporate finance.

Their ebbs and flows amplified the underlying contradictions of South African capitalism, including super-exploitative social reproduction (i.e. profiteering that extends beyond the normal source of surplus extraction, in capital-labour power relations) in the context of a dominant neoliberal ideology and the overproduction of mineral commodities in a volatile world economy.

The mid-August 2012 murders of more than 40 workers over the space of a week were a ghastly symptom of these contradictions. Revelations soon emerged about the dysfunctional relations between mining owners, the South African state, the main trade union, communities and environment:

+ political, in terms of the fusion of capital, politicians and the state security apparatus, especially the role of the key personality, Cyril Ramaphosa, in service to what was then the world’s third-largest platinum mining house;

+ labour-related, mainly in terms of the rock drill operators’ inadequate wages, deplorable working and residential conditions and the durability of migrancy (itself a condition dividing workers from most local residents along familial, ethnic and property-related class lines), but also with respect to intra-union battles which split workers and generated some of the initial August 2012 violence, followed by substantial retrenchments following a failed automation strategy and further intra-union violence in 2017;

+ gendered, with respect especially to the stressed reproduction of labour and community by women in the Nkaneng and Wonderkop shack settlements; and

+ environmental, due to the degradation visited upon these fastest-growing of South African urban and peri-urban sites, in which platinum (needed for allegedly low-emissions diesel engines, subsequently unveiled as a scam by Volkswagen and other automakers) is dug and smelted in high-carbon processes which also do substantial pollution damage to local water and air.

On the latter point, the entire platinum belt contributes to the extreme toxicity and overall pollution in South Africa. By the time of the 2012 Marikana Massacre, the country’s ‘Environmental Performance Index’ slipped to 5th worst of 133 countries surveyed by Columbia and Yale University researchers. The mining corporations’ and electricity supplier Eskom’s prolific contribution to pollution is mainly to blame, including coal mining that generates power used in electricity-intensive mining and smelting operations, such as Lonmin’s. In this context, Lonmin would logically consider its ongoing destruction of the platinum belt’s water, air, agricultural and other eco-systems to be of little importance – within a setting in which pollution and greenhouse gas emissions were ubiquitous.

Along with the dysfunctional local conditions, we must add the tendency to overproduction intrinsic to the capitalist system, especially at the peak of the 2002-11 commodity super-cycle. All these were contributing factors to the workers’ courageous strikes against Lonmin in 2012 and 2014 (the latter lasting five months), to the periodic social uprisings and to ongoing discontent.

These conditions exist in many parts of South Africa and the continent, leading to the sense of a multi-faceted Resource Curse associated with the extractive industries that leaves Africa massively impoverished. What makes the Marikana revelations even more unacceptable are artificial financial circumstances associated with the extraction process.

Again, these are not unique, but because of their intensity in Lonmin’s case, they deserve a great deal more discussion. For in the subsequent years since the massacre, only minor reforms and very little accountability have resulted.

The argument below focuses on three aspects of financing of relevance to Marikana’s ongoing misery:

1) microfinance in the form of short-term loans borrowed by mineworkers under conditions of usurious super-exploitation, leading to such levels of borrower desperation by August 2012 that an extended strike was necessary, lasting three weeks even after the massacre;

2) World Bank ‘development finance’ support for Lonmin’s ‘Corporate Social Investment’ specifically for mass housing supply, starting in 2007; and

3) Lonmin’s own corporate financing calamities, particularly during the hardest months of 2015 when the firm’s London Stock Exchange share price fell by an extraordinary 99.3%, and indeed, over the five years starting on the day before the 2012 massacre, its market capitalisation fell from £18.32 billion to just £307.85 million.

There were certainly some modes of labour and social resistance that also bear discussion, even if these did not reach anywhere near the point that bottom-up success could be claimed:

+ in fighting microfinance exploitation of borrowers, a demand arose from borrowers to declare null the ubiquitous ‘Emolument Attachment Orders’ – commonly known as garnishee orders or debit stop-orders on salaries – due to their having been filed in courts outside Marikana and indeed Northwest Province, a demand which was at least partially successful;

+ the World Bank’s International Finance Corporation (IFC) was challenged by Marikana women activists (including widows) in Sikhala Sonke and allied lawyers through the institution’s (supposedly independent) Compliance Advisor Ombudsman, although without success; and

+ nationalisation of Lonmin and all other mining houses operating in South Africa was initially called for by the ruling African National Congress (ANC) Youth League, whose key leaders were then expelled by party leadership – especially Ramaphosa – in 2012, after which they subsequently founded the Economic Freedom Fighters (EFF) party and won a large share of the platinum belt’s vote in subsequent elections.

The injustices at Marikana were officially adjudicated through the Farlam Commission set up by President Jacob Zuma just after the massacre. However, in these three financial sites of struggle for justice, Judge Ian Farlam’s investigation and findings were exceptionally weak, for none of these vital topics underlying the political economy of Marikana were considered to the extent necessary.

A new Commission of Inquiry would ideally be appointed under a future government, one not so explicitly implicated in the massacre as the regime run by Zuma and Ramaphosa, even if simply to remove the stain of Farlam’s unabashed collaboration with state and capital. A proper, balanced and rigorous Commission would consider all the aspects of Marikana’s political economy described below, and return some semblance of dignity to Pretoria’s investigating arms, which by all accounts were ravaged by Zuma-era malfeasance. (Two that were led by Judge Willie Seriti into the Arms Deal and Judge Jonathan Heher into tertiary education financing were similarly discredited by the crucial aspects they refused to consider.)

Farlam’s shortcomings were not unique, but reveal a deeper malaise when it comes to Pretoria’s consistent collaboration with companies like Lonmin. The inability of a neoliberal-nationalist ruling party to disguise its most extreme liaisons with transnational corporations and imperialism justly generates derogatory phrasing, e.g. by former Minister of Intelligence Ronnie Kasrils: “From 1991 to 1996 the battle for the ANC’s soul got under way, and was eventually lost to corporate power: we were entrapped by the neoliberal economy, or, as some today cry out, we ‘sold our people down the river’.”

Even South African capital’s leading organic intellectual – Business Day publisher Peter Bruce – had confirmed a decade earlier, “The government is utterly seduced by big business, and cannot see beyond its immediate interests.” Those interests, Bruce celebrated a few months before the massacre, were simple: “Mine more and faster and ship what we mine cheaper and faster.”

Just as brutal as how this extractivist metabolism of mining capital operates in relation to state power, on the one hand, versus the interests of workers, residents (especially women) and the ecology of the Marikana area and beyond on the other, is the amplification of these contradictions within the circuits of financial capital.

Finance, corporate managers and profits

The role of finance, in an ideal capitalist economy, is one of profit lubrication: serving to assure funding is provided to those who can best utilise it; permitting corporate projects otherwise considered too ‘lumpy’ for (cash-financed) short-term investments; allowing states the funding required to operate; and drawing consumers into their purchases of homes (through affordable mortgage bonds) and durable goods (on lay-by), all the while rewarding savings with a fair interest rate.

This is the textbook definition. It does not transfer easily to a country like South Africa.

As economies suffer ‘financialisation’ during epochs of capitalist crisis – such as the world and South Africa have experienced since the 1970s, as well as prior periods including the 1920s-30s and 1870s-80s – the role of bankers shifts from lubrication of capitalism into two other self-destructive terrains: speculation and control. As we see below, both financial speculation – the growing distinction between paper assets and real value creation – and excessive power exercised by creditors and investors, have undermined the economies of South Africa and nearly all other countries.

The process by which financiers gained sufficient power to call the shots at Marikana – in micro-mode with Lonmin workers’ household budgets, as well as through World Bank ‘development finance’ and corporate-financing via an indebted firm even as large as Lonmin (and beyond that, via credit ratings agencies which exert powerful influences over national budgets) – is typically missed by those comfortable with blaming the negligence or malevolence of personalities.

Naming and shaming individuals is extremely tempting in this case, given the heinous actions of the mining house’s then chief executive Ian Farmer. Enjoying a salary 236 times higher than the typical Lonmin rock drill operator, Farmer oversaw the degenerating material conditions of exploitation just prior to the massacre. He went on leave two days before the massacre due to cancer from which he subsequently recovered, so as to take up other mining directorships and then co-found the “Paternoster Group” of consultants.

(Reflecting the social power of this class, Farmer worked closely at that consultancy with high-profile liberal commentators Richard Calland and Lawson Naidoo. The latter were strongly criticised in 2017 by South Africa’s leading civil society activists for further Marikana massacre cover-ups serving Lonmin’s interests. All evidence to the contrary, Farmer later claimed that his firm’s failure to provide housing and basic services – as legally required – was not a primary factor in the workers’ discontent, wildcat strike and subsequent massacre.)

When he went on sick leave in 2012, Farmer’s colleague Barnard Mokwena became acting CEO, although he mainly served as human and public relations officer. Mokoena was later unveiled as having been an agent of Pretoria’s State Security Agency.

A third central figure at the helm of Lonmin was Ramaphosa, a man implicated in the mining house’s Bermuda tax avoidance via his Shanduka firm’s control of Lonmin empowerment partner Incwala. As Lonmin lawyer Schalk Burger testified to the Farlam Commission, “I have an instruction from the chief legal adviser to Lonmin to say the reason for the lateness of that agreement [to terminate the unjustifiable tax dodge] was that Incwala for very many years refused to agree to the new structure.”

Ramaphosa’s firm used Black Empowerment status to take advance dividends out of Lonmin so as to pay off the debt Shanduka had required for its equity investment in the firm. In addition, Ramaphosa’s role in the offshoring of funds in tax havens – especially Mauritius – at both MTN and Shanduka was unveiled in 2015 when MTN came under continent-wide criticism for capital flight, and again in 2017 with the ‘Paradise Papers’ revelations from a tax-dodge law firm email hack.

These three men epitomise why South Africa regularly wins the world’s leading spot in inequality measurements, and also the leading spot in the PricewaterhouseCoopers biannual international Economic Crime reports. The South African bourgeoisie, according to the Sunday Times, drawing on PwC’s 2014 report, is the “world fraud champ in money-laundering, bribery and corruption, procurement fraud, asset misappropriation and cybercrime.”

The lucrative extent of such capital-state relations mean South Africa’s corporate profit rate – as measured by the International Monetary Fund – has since 2000 typically been amongst the four highest in the emerging market peer group. Likewise, for reasons so apparent in August 2012, the World Economic Forum’s Global Competitiveness Report annually named the South African working class as the most ‘confrontational’ on earth from 2012-17.

In all of this, growing contributions of microfinance, ‘development finance’ and corporate finance to Lonmin’s accumulation – and then disaccumulation – of capital help explain why the economic context deserves far more attention, and why much more radical solutions are required than the three reformist, partial strategies noted above. Consider each in turn.

Microfinance super-exploitation

The most tragic lesson of Marikana from the standpoint of consumer finance, is that the ANC’s post-1994 entrapment by corporate power and adoption of neoliberalism meant the system of accumulation adjusted from one of direct coercion in the spheres of labour control (especially migrancy from Bantustans under apartheid-allied dictators) and racially-determined socio-political power, to indirect coercion by finance and law.

After 1994, the post-apartheid migrancy system and the evolution of labour relations on these mines did not improve the socio-economic conditions of workers. One central reason, as argued below, is the labourers’ fast-rising debt burden, itself a result of amplified household complications in which many miners raised families in both Marikana’s shack settlements and at their traditional rural homes.

But the most important post-apartheid force was a new approach to the capitalist penetration of the workers’ consumption norms, via credit whose repayment was compelled by stop-order deductions from their paycheques.

With the 2011 peak of the commodity super-cycle, mining houses had less surplus cash to compensate workers sufficiently to pay for household reproduction and repay debt. In early 2012 the second largest platinum firm, Implats, suffered a debilitating strike. In early 2013, the largest, Anglo American Platinum, announced the closure of shafts and the firing of 13,000 workers, though it retracted the most extreme threats and only a few thousand were laid-off.

From February to June 2014, the main firms were struck by 80,000 members of the Association of Mineworkers and Construction Union (Amcu), whose workers insisted on a 100% wage increase with a minimum of R12,500 per month salary (then $1420, but what with currency depreciation, only $875 by 2019). Most mining houses offered a minimum salary that was just 40% of that demand.

The workers were desperate, for their salaries were being docked regularly by a usurious garnishee system put in place by ubiquitous microfinance creditors and their lawyers. These were mostly the same white male Afrikaners (the names Grobler, Voster, Steyn and van Asperen stood out) who in earlier generations simply occupied the state bureaucracy when oppressing black workers.

Today, the financial and legal system reproduces a similar class-race power. By the time of the massacre, this household-scale debt crisis affected more than 13% of all mineworkers across South Africa and 9% of the general workforce. At peak in 2009, fully half the country’s borrowers were formally ‘credit impaired,’ having missed at least three debt repayments. By 2012, the main street of Marikana boasted more than a dozen ‘pay-day lender’ and ‘mashonisa’ (loan shark) microfinance offices, amidst a hodge-podge of low-level consumer-goods outlets.

Five kilometers to the east are the shack settlements of Wonderkop and Nkaneng, the latter of which in the Sotho and Xhosa languages means “taking away something by force.” The settlements’ tin structures are graced by few apparent state services and only scattered, trivial Corporate Social Responsibility projects. Yet both lie atop one of the world’s richest mineral deposits, with 80% of the world’s platinum stretching from nearby Rustenburg northeast through Limpopo Province.

Platinum soared as a valued metal in the late 1990s once not only jewellery but automobile applications were developed. Since then these deposits have mainly been controlled by the largest platinum mining houses: AngloPlats, Implats, Lonmin, Northam, Sibanye-Stillwater and Royal Bafokeng Platinum.

The typical Marikana rock-drill operator’s monthly take-home pay was, in the early 2010s, in the range of $500, with an additional $200/month granted as a so-called ‘living out allowance’ to spare Lonmin and other employers the cost of maintaining migrant-labour hostels. Lonmin paid its workers 10-25% less than did its two larger competitors.

Thanks to long-standing recruitment processes associated with apartheid migrant labour, most Lonmin workers were from the Eastern Cape’s Pondoland, as well as the neighbouring countries Lesotho and Mozambique. Many therefore maintained two households, having families to support in both urban and rural settings.

At the core of the Marikana conflict was that 3000 Lonmin rock drill operators demanded a raise to $1420/month. To get it they went on a wildcat strike for over a month, including three weeks following the massacre. They ultimately received what was reported as a 22% wage package increase. That success in turn catalysed wildcat strikes across the immediate mining region and then other parts of the country in September-November. In early 2013, the Western Cape farmworker strike raised daily wages by nearly 80%, to $12/day, reflecting the rising militancy.

There and in most low-income communities, microfinance indebtedness was central to the desperation conditions that prevailed, although all manner of other social, gender, economic, environmental and political factors are also critical.

The first report on how nearly two dozen of the murdered Marikana mineworkers suffered extreme over-indebtedness within the circuits of microfinance capital came from Mail&Guardian reporter Lisa Steyn in 2012: “Miners said they could access loans of up to 50% of the value of their net pay… Interest rates of 5% a month are charged, excluding a service charge of $5.70 a month and an initiation fee of a maximum of 15% on the value of the loan.”

Steyn continued: “Don van Asperen, general manager for Tshelete, which owns three cash-loan stores in Marikana, says mine workers make up 90% of its clientele. These clients will often repay their debt and take out another loan immediately, or one to two weeks later. ‘Some take two or three loans out each month. It’s a sad, vicious cycle,’ Van Asperen admits. ‘But that’s just the culture around the mines.’”

A ‘sad, vicious cycle’ is a poignant way to describe the brutal economics suffered by Marikana’s migrant mineworkers, the female residents who are caregivers to workers and their local families, and the region’s polluted ecology, in short, a process rife with what Marxist geographer David Harvey terms “accumulation by dispossession.”

The credit system is particularly unforgiving. At the time, the largest unsecured-credit lender, African Bank (with 40% of the market), was fined $34 million for fraudulent behaviour in manipulating credit affordability; it later went bankrupt. The microlenders were joined by lawyers, often Afrikaners who were once associated with state-based accumulation.

According to Moneyweb reporter Malcolm Rees, writing in 2012, there were (and remain) several legal mechanisms that caused loans’ compound interest and penalties to soar: “The miners’ spiralling debt problems could be one of the catalysts for the strikes at Lonmin’s Marikana mine because lawyers have charged more than double the initial loan amount in legal fees. In the extreme workers have been charged fees in excess of ten times the original amount lent. Combined with interest and other charges this has led to instances where workers have been invoiced for amounts three to 15 times the initial loan amount to clear their debt.”

This is not just a Marikana story, it is a more general reflection of super-exploitative processes associated with usury. Rees calculated that nearly $350 million was annually “exploited from SA’s workforce by collection attorneys and other debt collectors.” Kem Westdyk of Summit Garnishee Solutions estimated that at the time of the massacre, “10-15% of SA’s workforce has a garnishee order.”

The over-indebtedness of South African workers was not surprising, given that for many, their household financial status had degenerated since 1994. This was obvious in relative terms: wages as a share of the social surplus fell from 55.9% in 1994 to 50.6% by 2010 (although it rose slightly since).

But in addition, much greater inequality in wage income was also a factor, contributing to a rapid rise in the Gini coefficient over the same period. University of Cape Town researchers Josh Budlender, Ingrid Woolard and Murray Leibbrandt argued that by 2011, 63% of the country was officially under the ‘Upper Bound Poverty Line’ ($3.50/day) measuring basic food and essentials.

One reaction by the working class was to turn to rising consumer debt, to cover rising household consumption expenditures. From late 2007 to mid-2012, the outstanding unsecured credit load registered with the national credit regulator had risen 280%, to $13.75 billion by March 2012.

According to Rees, that meant that “at least 40% of the monthly income of SA workers is being directed to the repayment of debt.” A University of Pretoria Law Clinic study in October 2013 confirmed that 8% of nearly 8.5 million employees in SA’s formal sector had a deduction made for either debt, maintenance or an administration order; in the mining sector the ratio was 13%, or 66,000 workers.

The problem stretched beyond the working class, for the economy had become addicted to consumer credit. By all accounts, if there was a factor most responsible for the 5% GDP growth recorded during most of the 2000s, by all accounts, it was consumer credit expansion, with household debt to disposable income ratios soaring from 50% to 80% from 2005 to 2008, whereas overall bank lending rose from 100% to 135% of GDP.

Credit overexposure began to become an albatross around 2007, however, with non-performing loans rising by 80% on credit cards and 100% on bonds compared to 2006. Full credit defaults as a ratio of bank net interest income soared from 30% at the outset of 2008, to 55% by the end of the year.

By late 2010, the main state credit regulator, Gabriel Davel, registered ‘impaired’ status for 8.3 million South African borrowers, a rise from 6.1 million impaired borrowers in 2007: “There are a variety of mechanisms through which the ‘reckless lender’ can transfer the cost of default to its competitors. For instance, by applying coercive collection mechanisms, it ensures that its payment gets prioritised and that the client default elsewhere, or cut back on household expenditure, school fees etc.”

A government authorised credit-rating amnesty in early 2013 allowed for the reopening of loan facilities to two million borrowers earlier deemed not sufficiently credit-worthy, in a move that can be interpreted as a short-term palliative after lobbying by the retail sales industry.

This is the early-2010s context for the Marikana massacre often ignored by those not familiar with consumer finance. Yet there were no major new regulations imposed on the retail credit sector notwithstanding the revelations from a few business journalists.

One of these, Steyn, also remarked upon how difficult it was to end super-exploitation notwithstanding the golden opportunity the Farlam Commission represented: “The matter of debt is not mentioned in the 646 pages of the report of the Farlam commission of inquiry and this is regarded as a glaring omission. The commission was tasked with investigating the underlying causes that led to the Marikana massacre in 2012. In Lonmin’s statement on the Farlam commission’s report, it said it had placed particular emphasis on living conditions and employee indebtedness, ‘two key issues that we believe will make a profound impact on the wellbeing of our employees’.”

It truly was a glaring oversight by Farlam and his team. A month after the massacre, the world’s leading intellectual critic of microfinance, Milford Bateman, analysed the conditions associated with microfinance in a leading Johannesburg newspaper, The Star, as well as Le Monde Diplomatique: “We have perhaps just witnessed one of the most appalling microcredit-related disasters of all in South Africa. Extreme over-indebtedness by workers apparently helped precipitate the Marikana massacre on August 16.”

Bateman compared the local situation to other microfinance meltdowns: “Thanks to a number of ‘boom-to-bust’ episodes precipitated by over-lending, microcredit has come to be rightly known as the developing world’s own ‘sub-prime’ financial disaster, with ‘meltdowns’ in Bolivia, Bosnia, Pakistan, Nicaragua, Morocco and most catastrophically, in India, site of 250,000 suicides by indebted farmers.”

In part, Bateman blames the 2006 winner of the Nobel Peace Prize: “Microcredit was sold to the world by Muhammad Yunus and his acolytes as a simple, and simply fantastic, intervention that would help the poor escape their poverty. Perhaps nowhere more than in the horrific experience of the Marikana miners has such faith been shown to be misplaced, and the potentially catastrophic results of desperation-level micro-debt revealed with such awful clarity.”

There are many precedents in South Africa for failed microfinance, and indeed the entire sector has witnessed major shake-outs during prior economic crises, especially in 1998 when many microfinance NGOs went bankrupt because the national interest rate rose by 7% within just two weeks, generating extreme financial stress.

Initially, the sector’s problems also reflected the pent-up surge of formal sector banking facilities made available to the black majority after the end of apartheid, so microlenders had difficulties competing.

But the crucial problem, even the ANC’s Economic Transformation Committee conceded in 2005, was financial over-exposure: “The commercial micro-lending sector has rapidly reached the limit of its expansion. The nature of its business model is such that it can only extend financial services to the salaried workforce. The vast majority of the ‘unbanked’ fall outside this category. Furthermore, the objectives and institutional culture of the high street lender can hardly be considered appropriate for the implementation of an asset-based community development strategy.”

That meant, according to practitioner Ted Baumann (writing in The Journal of Microfinance in 2005), that rural people were unable to generate surpluses sufficient to make loan repayments: “Unlike peasantries elsewhere in Africa, South Africa’s rural poor lack access to basic means of production, such as land, because of unresolved issues of comprehensive settler dispossession. They live in crowded rural villages squeezed between commercial farmland (no longer exclusively white) and tourist-oriented game reserves.”

Likewise for urban residents, Baumann argued, informal sector income is “constrained by South Africa’s manufacturing and retail sectors, the most advanced in Africa, which relegate small-scale trading and manufacturing to the margins. Because of their lack of access to productive resources, South Africa’s poor are almost totally dependent for their survival on the output of the formal economy.”

For the lead scholar of South African consumer credit, University of London anthropologist Deborah James, the post-apartheid state did the most damage to household finances: “Its neoliberal dimension allows and encourages free engagement with the market and advocates the freedom to spend, even to become excessively acquisitive of material wealth. But it simultaneously attempts to regulate this in the interests of those unable to participate in this dream of conspicuous consumption. Informalisation intensifies as all manner of means are devised to tap into state resources.”

But these resources are relatively scant, as a result of the overall nature of the transition from apartheid to neoliberalism. It was here that the attraction of global finance became so strong. And so it was here that the world’s premier development lender also entered the financing terrain in Marikana with enormous ambitions.

World Bank ‘development finance’ for Marikana’s underdevelopment

The Farlam Commission’s failure to connect the dots between micro-finance and super-exploitation of Marikana workers was matched by just as suspicious an analytical deficit when it came to a large ‘development finance’ deal with Lonmin.

At the same time that Lonmin workers were meant to live in housing that was not even of 19th century quality, the firm was removing $148 million to Bermuda from 2007-11, ostensibly for marketing expenses, according to Dick Forslund of the Alternative Information and Development Centre. In addition, from 2007-11 Lonmin paid dividends worth $510 million, while not, as London scholar-activist Andrew Higginbottam put it, “fulfilling its much lesser $80 million legally binding commitments to build social housing for its workers.”

The firm’s major investors were fully aware of this scam, as discussed below. At the same time the tax dodging was underway, the World Bank’s private-sector wing, the IFC, was simultaneously investing $15 million in an equity position in Lonmin, via the Johannesburg Stock Exchange.

The IFC’s objective was to support “the development of a comprehensive, large-scale community and local economic development program.” This stake, along with another $35 million share equity purchased subsequently, brought with it the IFC’s Investment & Advisory (I&A) services. Although meant to support the community development strategies, I&A themselves became the subject of controversy.

Then, on top of the $50 million equity investment, in 2007, the new World Bank president, Robert Zoellick, authorised a further loan facility of $100 million, although Lonmin never drew this down. As leading business journalist Rob Rose reported at the time, “Lonmin CEO Brad Mills said the plan was to use the [$100 million] cash to create “thriving communities” around Lonmin’s projects so that when the platinum was depleted and the miners left, the communities would be ‘comfortably middle-class’ and able to support themselves.”

Continued Rose’s 2007 report, “’We intend to use 100% of this facility to facilitate partners in our business,’ Mills said. Lonmin would use part of the cash to build 5,000 houses in the next five years for community members, with 600 scheduled to be built this year.”

Ramaphosa, who joined the Lonmin board in mid-2010, was asked about the 5500 houses promised by the firm when testifying at the Farlam Commission. He claimed he had no real idea why the alleged financial constraints to building these had arisen in 2006-08, before the advent of the world financial crisis.

Before that 2008-09 crisis, when Lonmin should have already built more than 2000 houses for its workers, the IFC regularly bragged about Lonmin’s “developmental success” resulting from the introduction of IFC “best case” practices, ranging from economic development to racially-progressive procurement and community involvement to gender work relations.

In reality, as church-based Bench Marks Foundation (a mining watchdog NGO) reported in 2007 just as the IFC was getting involved, and also in 2012 after the main IFC work had been completed, Lonmin failed to meet any reasonable definition of what corporate social responsibility on the platinum belt would address.

Lonmin was, according to Bench Marks, guilty of subcontracting, including labour broking; abusing migrant labour with appalling living conditions, mitigated by the living-out allowance; ineffectual community social investments and lack of meaningful community engagement and participation; and environmental discharges and irresponsible water use, especially in relation to local farming.

This was a case of exceptional financial irresponsibility. From Washington, DC, the Center for International Environmental Law argued in 2012 that the World Bank continued to ignore critical information about Lonmin both before and after its investments: “Despite criticism from communities and NGOs that industrial mining projects often result in serious human rights violations and little economic development, the IFC continues to justify its investments as a ‘key source of jobs, economic opportunities, investments, revenues to government, energy and other benefits for local economies.’”

Exactly two weeks after the massacre, World Bank President Jim Kim went to nearby Pretoria and Johannesburg for a visit, but he neglected to mention – much less visit – his institution’s Lonmin investment. Systems of accountability within the Bank were soon revealed as deficient, as women residents of Marikana would later find.

From 2012-13 an investigation by the IFC’s independent Compliance Advisor Ombudsman (CAO) transpired, in which the CAO objected to the IFC’s evaluation of “industrial relations and worker security” problems that were apparent over at least the 18 months before the August killings.

The CAO found the IFC had inadequate monitoring systems at several crucial points:

+ the IFC’s response to Lonmin’s dismissal of 9,000 employees in 2011;

+ the limited discussion between the IFC and Lonmin over worker-management relationships;

+ the IFC’s response to the death of one employee and assault of five others on their way to work in April 2012; and

+ the adequacy of IFC reports after visits to Lonmin, especially since sections of some of the reports seemed to have been copied from previous years.

However, in the absence of a formal complaint from workers, the CAO argued that no link could be established between these concerns and the deaths at Marikana. He closed the case in 2014.

As GroundUp journalist Alide Desnois remarked, “neither the IFC evaluation teams nor the World Bank’s own evaluation team, which reported in June 2012, had much to say about employment issues at Lonmin in the run-up to the events in August. After the killings, the IFC team ‘noted violence at Lonmin occurring in the context of increasing tensions between rival unions in the mining sector in South Africa, mines being shut down, worker lay-offs and declining workers’ bonuses.’”

Likewise, when it came to the multiple crises of social reproduction and community underdevelopment in Marikana, especially within the shack settlements next to the Lonmin platinum mine, another deficiency was quickly apparent: inadequate state regulatory measures associated with the Mineral and Petroleum Resources Development Act (MPRDA) and its Social and Labour Plans.

Those agreements were stipulated in precise terms to reflect agreements Lonmin made with stakeholders under the MPRDA, and featured commitments to convert single-sex hostel accommodation to family units and to build an additional 5,500 houses for migrant workers. From 2007-09, 3,200 houses were scheduled for construction, as well as 70 hostel conversions. But only three show houses were built and only 29 hostels converted by the end of 2009.

According to the Farlam Commission report, Lonmin had claimed the MPRDA phrasing “was not an obligation to build houses, but merely an obligation to broker an interaction between their employees and private financial institutions in terms of which employees would be able to obtain mortgage bonds to build their houses. This attempt by Lonmin to wash its hands of an obligation that it repudiated must be rejected.”

Ramaphosa headed the Lonmin board’s Transformation Committee tasked with this work from mid-2010 to early 2013. For this failure, Lonmin was not only condemned by the Farlam Commission, but also was compelled to rapidly build houses under its MPRDA agreement. The demand was finally agreed to by Lonmin in late 2016, but only after state threats of withdrawing the firm’s mining license. Only then were hundreds of houses built within a year.

In spite of its tough critiques of Lonmin’s violation of the MPRDA, the Farlam Commission entirely ignored the IFC’s complicity, including the unfulfilled housing finance offer. In 2007, the then Lonmin CEO (Mills) had announced, “Our partnership with IFC will help to enhance Lonmin’s continued commitment to the long-term sustainability of our local communities and to allow us to build on our ongoing work to create mutually beneficial relationships with these communities.”

The IFC’s 2010 video report on the initial stage of the partnership bragged that the deal “helped transform the way the world’s third-biggest platinum miner operates.” The same year, the IFC’s Strategic Community Investment best practices handbook featured Lonmin’s Marikana operation: “The company has embarked on a multi-stakeholder effort to help bring prosperity and sustainable development to the local communities in which it operates. Alongside Lonmin, there are three key stakeholder groups – the traditional authority, local government, and local mining companies – that share the same vision for socioeconomic development.”

But the stakeholders specifically excluded the people upon whom the vision was to be imposed – workers and community residents – and as a result, furious women’s residents of Nkaneng shack settlement formed a group, Sikhala Sonke (“We cry together” – later the subject of a major documentary film, Strike a Rock), aided by leading public interest lawyers at Johannesburg’s Wits University Centre for Applied Legal Studies.

In 2015, they laid a complaint against the IFC through the CAO, citing: “an absence of roads, sanitation and proper housing, as well as accessible, potable, and reliable sources of water. Further, the Complainants allege that to the extent the mine offers benefits in the form of employment, less than 8% of employees currently are women. The complainants also allege environmental pollution, specifically relating to air and water. They further allege failure by Lonmin to provide the Nkaneng community with adequate health and educational facilities which were promised at the inception of the project.”

Indeed there were persistent problems with men forcing women mine workers into unwanted underground sexual relations, and Lonmin was no better than other mining houses in spite of the IFC intervention, according to doctoral research by University of Cape Town scholar Asanda Benya.

IFC statements about gender equity at Marikana have focused upon the rising (albeit still small) share of women in the workplace. IFC mining principal investment officer Robin Weisman again claimed Lonmin as a success story in 2017.

As Mining Weekly reported (with no mention of sexual harassment in the mines or the Sikhala Sonke fight against the IFC), “In July 2007, the IFC entered into a three-year partnership with Lonmin to promote the sustainable development of Lonmin’s workforce and the communities in the vicinity of its mining operations. A key focus of the partnership was to develop a Women in Mining programme, which sought to promote the employment and retention of women in Lonmin’s workforce.”

Instead of monitoring community development and gender equity directly, “the IFC has played the role of an ‘absentee landlord,’ relying on the annual reports of the company. The IFC should have been more vigilant around their investment, but at least they have a mechanism to receive complaints,” according to Wits lawyer Bonita Meyerfield.

The Sikhala Sonke complaint pointed out that even a year before it invested in Lonmin, the IFC itself held a high-minded, self-congratulatory stance on its own ‘Performance Standards’: “IFC endeavors to invest in sustainable projects that identify and address economic, social and environmental risks with a view to continually improving their sustainability performance within their resources and consistent with their strategies. IFC seeks business partners who share its vision and commitment to sustainable development, who wish to raise their capacity to manage their social and environmental risks, and who seek to improve their performance in this area.”

In spite of tough criticism of the IFC and Lonmin, the CAO ultimately proved useless at fostering change, and Sikhala Sonke gave up on internal reform, in open disgust.

In sum, the IFC’s regular, ridiculous back-slapping antics regarding Lonmin’s socio-economic development and women’s empowerment at Marikana were just another reflection of how ‘development finance’ amplified South Africa’s gendered underdeveloped. But this was just one institutional reflection of the deviant, contradiction-riddled way corporate finance related to Lonmin.

Corporate financing chaos in the context of commodity price crashes

The World Bank’s bizarre embrace of Lonmin’s ill-fated Marikana operation was not – as argued above – actually ‘development finance’, but instead a disguised mode of under-regulated corporate finance. Other convoluted ways in which corporate finance continues to affect Marikana political economy are also worth even a brief discussion.

The best known problem was the way Lonmin’s supposed marketing operations in Bermuda served as a site for “base erosion and profit shifting,” i.e. a source of at least $100 million in capital flight from South Africa to Bermuda using a classical transfer pricing tax dodge. The Farlam Commission did indeed mention this, but only in passing (so as to question the alleged lack of financial resources housing construction).

When information about the tax dodge initially began to appear in late 2014 after research by the Alternative Information and Development Centre, Lonmin attempted unsuccessfully to suppress the analysis. A few months later, in mid-2015, AIDC and the main trade union in Marikana, Amcu, reported that from 1999-2012, overall annual profit repatriation to the Lonmin subsidiary Western Metal Sales in Bermuda was at least R400 million on average between 1999 and 2012, the equivalent of at least R3 500/month extra for each rock drill operator’s wages.

This sort of profit shifting was common practice amongst transnational corporations operating from South Africa. At the same time, researchers in the University of Manchester Leverhulme Centre for the Study of Value argued that De Beers used transfer pricing and misinvoicing worth $2.83 billion from 2004-12 in order to minimise its tax liability. The extent of such behaviour was estimated by economist Seeraj Mohammed to have reached 23% of GDP in one peak year of illicit financial outflows, 2007.

The extractive industry profits undergirding this outflow reached record levels during the 2002-11 commodity price super-cycle, in which South Africa’s four main mineral exports of platinum, coal, gold and iron ore soared in price and output. China’s vast Keynesian investment boom raised global commodity prices in a last gasp for the extractive industries from 2009-11, following the crash of platinum from $2270/ounce in mid-2008 to $800/ounce in early 2009.

In 2014, Wits University economists Andrew Bowman and Gilad Isaacs exposed the main platinum firms for their massive ‘resource rents,’ especially during the 2000-08 period when Lonmin’s annual rate of return was 76%. From 2000-13, the annual profit rate was 31%, double the prevailing rate of the top forty South African firms.

But in the period 2011-15, mining proved disastrous for an economy that had grown so reliant upon minerals exports. It is true that the local Rand price of those minerals fell faster than the global commodity index – the peak currency was R6.3/$ in 2011 and it fell to a low of R18/$ in early 2016 (subsequently hovering in the R13-15/$ range into 2019), whereas the prices of four main minerals fell 50%.

But that also created a temptation for mining houses to increase output, thus exacerbating the global gluts, in search of profits, rather than reduce supply. The platinum stockpile that resulted allowed the industry to easily weather the five-month labour strike in 2014. But the years since 2008 witnessed a 63% cut in the metal’s US dollar price, to the point it fell below $800/oz in late 2018. (Given a similar cut in the value of the South African currency, the rand price of platinum was relatively unchanged in terms of local costs and prices of production.)

Setting aside the implications of the volatile global price of minerals for trade, the most disastrous macroeconomic aspect of corporate mining finance was the net outflow of corporate dividends and interest paid to owners or creditors of foreign mining capital. At peak this reached $11 billion in the first quarter of 2016 (measured on an annualised basis), 30% higher than the equivalent 2015 level, when prices were crashing.

At the time, only one other country among the 60 largest economies, Colombia, had a higher current account deficit than South Africa, as a result of the balance of payments deficit. Because repatriating profits must be done with hard currency, South Africa’s external debt had by then soared to 39% of GDP, $125 billion, from a level less than 16% of GDP ($25 billion) in 1994. By 2018, it exceeded $180 billion, or 51% of GDP.

The pressure to raise hard currency for foreign shareholders, in turn, quickened the metabolism of extraction in which capital, labour and nature interact. The mass of profits (in hard currency) that mining corporations require to maintain the confidence of overseas owners and to service debt must be kept at a satisfactory level. If commodity prices drop, one way to address the problem is to increase the volume of output, anticipating that costs of production in a specific site are far enough below competitors’ costs to drive them out of business.

This appeared to be the strategy adopted by platinum miners in South Africa, for as the minerals slump began in 2011, many of the global mining and smelting corporations squeezed harder, for they too faced attack by investors. Anglo American, Glencore and BHP Billiton each lost more than 85% of their share value in 2015 alone, while Lonmin fell by 99.3%.

Desperate, the platinum mining houses produced far more output in 2015: a 46% increase over 2014. To be sure, that was a low base year due to the mineworkers strike, but in the platinum sector, “Production in 2015 was 4.2% higher compared with 2013, and 8.3% higher compared with 2012,” according to the official statistical agency StatsSA, while overall, mining output rose 3.5% in 2015 compared with 2014.

However, that strategy of offsetting shareholder value destruction with higher production also entailed exporting profits ever more rapidly, rather than reinvesting them in local plant, equipment and machinery. The rapid haemorrhaging of corporate dividend outflows is all the more frustrating because corporate, parastatal and fixed investment shrank nearly 7% in early 2016, while government investment also fell 12%; investment/GDP levels fell from their post-apartheid peak of nearly 24% in 2008, to less than 19% a decade later, substantially below the world average.

(This trend isn’t peculiar to South Africa, for according to the United Nations, in 2011 $224 billion in Foreign Direct Investments were sunk into the extractive industries, but in 2015, there was just $66 billion.)

Yet at the same time as fixed disinvestment was underway, a casino-like atmosphere prevailed in South African corporate finance. The market capitalisation of corporations listed on the Johannesburg Stock Exchange soared from a 2008 level of 150% of GDP to more than 350% by the time of the peak in early 2018 (a measure known as the ‘Buffett Indicator’). This share bubble was vastly higher than not only relatively speculative world levels, but higher than any other national share market in world history.

The only major new South African fixed investments were being made by parastatals, especially the corruption-riddled electricity company Eskom’s over-priced and ecologically destructive Medupi and Kusile coal-fired power generation plants (4800 MW when finally built), running years behind with massive cost overruns at $15 billion each.

These and other Eskom coal-fired power plants already supply a disproportionately large share of their electricity to mines and smelters (including Lonmin’s). The bias towards serving these carbon-intensive users reflects the power of the Energy Intensive User Group – the country’s three dozen largest electricity purchasers – which often negotiated massive price discounts. An even more destructive mega-project by the Transnet rail and port agency lies ahead: the $60 billion railroad expansion for planned mineral exports from Limpopo Province, focusing on 18 billion tonnes of coal plus a much smaller amount of platinum (including Lonmin’s).

The massive state subsidies associated with these mega-projects, mainly enjoyed by transnational corporations, are especially unsatisfactory given not only so much social unrest over unmet basic needs, including basic infrastructure. In addition, the high levels of ‘economic crime’ associated with procurement infest the construction and mining industries. PwC’s forensic services official Louis Strydom remarked in the firm’s 2016 survey, “We are faced with the stark reality that economic crime is at a pandemic level in South Africa.”

The authorities’ inability to uncover such crime, prosecute it and put criminals into jail is no secret, for more than two thirds of PwC’s 232 South African respondents believe Pretoria lacks the regulatory will or capacity to halt the top financial criminals. In 2018, the South African capitalist class was once again considered the world’s most corrupt, beating Kenya, France and Russia in the subsequent three rankings, according to PwC. Lonmin’s Bermuda financing shenanigans are the tip of the iceberg.

Finally, with Lonmin continuing to suffer losses, in 2015 the South African Public Investment Corporation (PIC) – a civil service pension fund with more than R2 trillion ($143 billion) in assets – increased its share of the firm from 7 to 30% ownership, so as to lead a $400 million recapitalisation that was undersubscribed. It was only in late 2017, however, that PIC chief executive Daniel Matjila – who a year later was forced to resign after multiple corruption disgraces – began to make quite moderate demands: two seats on Lonmin’s board and its move to a primary stock market listing in Johannesburg, not London.

As Reuters reported, “Matjila said PIC’s state shareholders [i.e. the Treasury], keen to keep jobs in South Africa’s mining industry, had expressed concern in a recent meeting about its exposure to Lonmin and what action was being taken ‘to mitigate risk. We don’t wish to exit. Let’s put representatives on the board to at least give guidance to management, to start taking the right decisions needed to stabilise the company and take it forward.’”

Once Lonmin directors approved the company’s sale in late 2017, the PIC’s subsequent decision to shift its ownership to Sibanye-Stillwater, instead of promoting a nationalised industry as labour demanded, ended the option of state rescue and ownership. The 2017-19 takeover of Lonmin would be rocky. The Johannesburg mining house Sibanye was once part of Goldfields until it was split off in 2013 to run three aging gold mines, and then conducted a massive merger with the US mining house Stillwater.

As a result, complained a Deutsche Securities analyst just before the Lonmin takeover, “We currently cannot see meaningful free cash flow from any of Sibanye’s divisions until 2020, which coupled with a significant debt load of R22 billion ($1.6 billion), leaves us holders of the share on a valuation basis.”

Sibanye’s answer was that the excess smelting capacity at Lonmin would justify an increase in the concentration, but an underlying problem remained, according to a Nedbank analyst: “it doesn’t resolve oversupply of the PGM (platinum group metals) industry.” Replied Sibanya’s Neil Froneman, “the larger regional PGM footprint will create a more robust business, better able to withstand volatile PGM prices and exchange rates.”

Indeed with both platinum prices and Lonmin’s share value having fallen so dramatically over the prior years, this would have been the time to consider how best to resist the devaluation of the world’s vast over-accumulation of platinum. (One partial rebuttal is that platinum recovered slightly in price, but other metals in the same group, especially palladium, have much greater longer-term potential in renewable energy and their prices are much stronger.)

To be sure, London Stock Exchange investors had devalued the extreme over-capacity during 2012-15, but more to the point, the question for workers and indeed the entire society was whether Lonmin could have been revalorised in some way.

Ideally, that would be under the control of a strong, fair, ecologically-minded parastatal owner, able to strategically move the company towards an appropriate beneficiation strategy for both local and global benefit, not a passive, corrupt investor such as the PIC. However, such an owner was simply not in existence in post-apartheid South Africa; the adverse balance of forces arrayed against Lonmin’s workers, community and surrounding ecologies was simply too extreme.

In prior eras, such as the 1920s-80s, there would have been little hesitation by state resource managers to snap up the Lonmin assets at such an extraordinary discount (to reiterate, 99,3% cheaper in price in December 2015 compared to January), especially given that Lonmin regularly claimed world-class smelting capacity and a platinum resource base of 181 million ounces plus 32 million ounces in reserve, nominally worth more than $200 billion.

Yet the firm’s worsening problems meant it was operating its mines at only a $3/ounce profit in 2017. The essential dilemma, all analysts agreed, was that in following the logic of capitalist expansion, Lonmin had generated vast excess capacity, both in production and smelting.

Indeed overexpansion still appears debilitating, for as one headline read in March 2019, “South Africa output jump will push oversupply to 6-year high,” based on World Platinum Investment Council forecasts of the platinum surplus rising from 645,000 ounces in 2018 to 680,000 ounces in 2019.

The main catalyst was a 6% increase in mine output and inventory sales anticipated from South Africa: from 4.41 million ounces to 4.73 million ounces. (There is also a much lower Russian and Zimbabwean output – both were anticipated by the Council to remain flat at 675,000 and 410,000 ounces, respectively, in 2019 – and North American output was expected to rise from 360,000 to 410,000 ounces, not to mention a 3% increase in platinum recycling output to 1.96 million ounces).

The one force that can rapidly reduce industry oversupply is a militant trade union, Amcu, the one responsible for the two major strikes at Marikana, in 2012 and 2014. Although in 2019 the union was defeated in a gold sector strike, workers may well continue to express their militancy.

The extent to which unions have affected Lonmin’s share price, along with other factors it cannot readily change, was reflected in a 2017 report in Mining Review Africa: “In South Africa, the largest platinum group metals producer in the world, the sector will continue to suffer from high costs, labour unrest and exchange rate volatility… [while] demand for platinum, used primarily in diesel-fueled vehicles, continues to take a hit from the repercussions of the Volkswagen diesel emissions scandal.”

The latter reference is to the world’s largest car manufacturer, which in 2015 was prosecuted (and paid more than $15 billion in fines) for the “defeat device” software its engineers illegally installed in diesel-powered vehicles. The scam allowed 40 times the legal limit of nitrogen oxide emissions, a chemical not only dangerous when generating smog (and asthma) but also as a greenhouse gas, 300 times more damaging than carbon dioxide.

A leading platinum marketer, Huw Daniel, told Mining Weekly in 2017 that one reason vast over-supply of platinum persisted was that “demand took a knock following vehicle manufacturer Volkwagen’s emissions scandal and extensive anti-diesel sentiment.”

Of 8.5 million tonnes of demand for platinum in 2016, Daniel noted that 40% was generated in the automotive sector. As the scandal broke in 2015, reporter Jo Confino complained about VW’s broader damage “to the corporate sustainability movement. Volkswagen’s actions will fuel the cynics who believe businesses are just paying lip service when it comes to issues like climate change and resource scarcity.”

Confino continued, “What the Volkswagen scandal illustrates is that profit maximisation is so deeply embedded in corporate culture that when push comes to shove, the vast majority of companies will put the bottom line above any moral case for change, and sometimes even cheat to keep the short-term profits coming in.”

The bottom line for Lonmin should have included longer-term support for greenhouse-gas emissions cuts to reduce climate change, including advocacy of platinum fuel cells in new automobiles, buses and other vehicles. Platinum plays a catalyst role during hydrogen’s conversion into electricity, so as various kinds of transitional processes are under consideration, the merits of platinum as an ingredient can be better understood.

As Steve Phiri – the CEO of one of the competing mining leaders, Royal Bafokeng Platinum – put it in late 2017, “Our message to particularly the regulators and government is that you cannot produce 80% of the world’s platinum group metals and still be on Euro 2.” He was referring to the terribly low anti-pollution standards prevailing in South Africa.

However, since neither the South African government, Lonmin nor the IFC appeared to be taking seriously the need to enforce social and environmental standards in Marikana nor in South Africa more generally, and since the overall terrain of corporate finance was potholed with massive capitalist contradictions, it will be up to civil society – specifically, local and international campaigning movements – to target the firm’s London headquarters and its purchasers, including the German firms BASF and Volkswagen, even after Sibanye takes up Lonmin’s tainted ownership.

Financially-amplified super-exploitation

The dysfunctional financing systems behind the catastrophic capital-labour, capital-community and capital-capital relations at Lonmin’s Marikana operations, culminating in the 2012 massacre, have largely been left out of public policy and corporate reform.

Above, we have considered how microfinance, ‘development finance’ and corporate finance all enhanced Lonmin’s accumulation of capital during the commodity super-cycle’s years of plenty, but then created debilitating contradictions in the years of platinum devaluation (particularly in 2008 and 2011-15).

What this meant for Marikana’s ‘development’ during the good years was a distorted mode of resource cursing that gave South Africa the superficial appearance of prosperity – but at the same time, amplified the main features of what is undeniably a deep-rooted super-exploitative system underlying mines like Lonmin’s at Markiana.

In short, layered atop Lonmin’s other modes of surplus value generation, brutal social reproduction and resource extraction, finance became far more of a destructive than constructive input.

Culpability for the underdevelopment finance that left Marikana ravaged is not likely to come from state and capital; instead, a reckoning will have to come from popular movements, including labour, community, women’s and environmental organisations.

Some encouraging signs could be observed in recent years. However, given the limits of reformist approaches to date, much more needs to be done to popularise understanding of the unreformable, irredeemable ways that finance amplifies uneven and combined development in Marikana, in South Africa, in Africa and in the world at large. Only then can society shift the burden of this damage back to the financial institutions and corporates which are to blame, to the point nationalisation of their asset base is both sensible and politically feasible.

The mining industry’s critics have a great deal to say about Lonmin as a case of extreme exploitation. But it is in financial super-exploitation that critical analysis and militant resistance can turn. The three associated markets – microfinance, ‘development finance’ and corporate finance – illustrate many of the worst capitalist pathologies on display at Marikana over the past decade.

History offers concluding lessons. Tiny Rowland died two decades ago, in 1998, after losing control of Lonrho five years earlier due largely to his embarrassing ties to Libyan dictator Muammar Gaddafi. The firm then rebranded: “Integrity, Honesty & Trust” slogans adorned billboards at Marikana, as the bullets flew.

A decade after Rowland’s death, Lonmin managers must have been sufficiently confident that with the World Bank backing its community investment strategy, it could mainly ignore the nearby Nkaneng and Wonderkop shack settlements’ degradation. The lack of clean running water, sanitation, storm-water drainage, electricity, schools, clinics, and any other amenities make these as inhospitable residential sites to reproduce labour power as any in South Africa – but that didn’t stop the IFC from its surreal poster-child profiling of Lonmin as a community investment success story.

Lonmin’s approach to the Marikana community’s troubles was initially insignificant. Instead of building decent company housing for migrant workers, it relied on the inadequate living-out allowance, much of which was just added to wages targeted for remittance to the workers’ home region. The neo-apartheid migrancy system left Nkaneng and Wonderkop in misery.

So while mineworkers continued to maintain relations especially to Transkei roots, the rise in dependents per male labourer was noticeable in the post-apartheid era. And under such conditions, workers and their Marikana families depended ever more upon microfinance collateralised with stop-order payments from their meagre salaries. But as shown above, that soon led to over-borrowing – and then, when in 2011-12 the costs of this strategy became prohibitive, the workers struck for a living wage, for performing some of the most difficult work in South Africa, rock-drill operations.

Somehow throughout all this abuse, official and mass-media mantra sloganeering has focused on attracting ‘Foreign Direct Investment’ so as to achieve the rates of investment that characterised high apartheid. But while the rate of fixed capital investment to GDP soared from 18 to 32% from 1962-76, the era also witnessed the brutal repression of black, democratic political parties, social movements and trade unions.

In contrast, during the commodity super-cycle, the 2002-08 reinvestment blip in South Africa was much weaker than the earlier era’s, but it did have a certain logic, driven partly by the resurgence of the Minerals Energy Complex. In the specific case of Lonmin, we see that prior to August 2012, a public relations onslaught apparently gave its executives confidence that long-standing abuse of low-paid migrant labour could continue unabated, especially once Ramaphosa joined the board in 2010.

But what this case confirms is just how fragile Lonmin became, even with assets such as Ramaphosa and the commodity super-cycle. The bubbling of tensions into armed warfare in mid-2012 had many causes, of which three located within micro-finance, ‘development finance’ and corporate finance were explored above.

Ultimately, though, since very few if any of these problems in the financial and extractive circuits of capital have been properly articulated by South Africa’s elites (including Farlam), much less resolved, we can expect yet more cycles in which the same causes create the same tensions, although hopefully not with the same effects. Otherwise, it truly will be a case of Marikana Reloaded.

(Patrick Bond teaches political economy at the University of the Witwatersrand in Johannesburg; for a full account including references, contact pbond@mail.ngo.za)

Platinum price (US$/ounce), 1986-2019

Gross fixed capital formation (investment as a% of GDP), 1960-2018

Market capitalisation of listed domestic companies (percent of GDP), 1986-2017

Lonmin share price (British pence), 1994-2019

Sibanye-Stillwater share price (SA cents), 2014-19