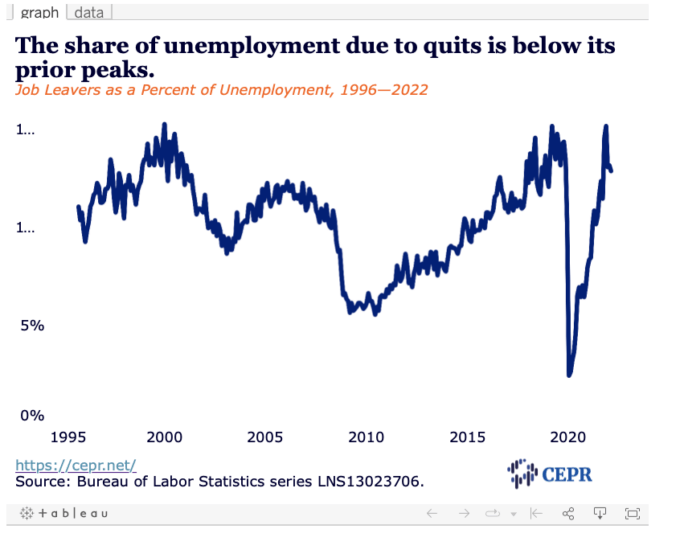

The drop in unemployment due to quits undermines the story of an out-of-control labor market.

The economy added 390,000 jobs in May, while the unemployment remained unchanged at 3.6 percent for the third consecutive month. The May report showed clear evidence that the labor market is normalizing with wage growth continuing to slow.

The annualized rate of wage growth comparing the last three months (March, April, and May) with the prior three months (December, January, and February) was 4.3 percent, down from the 5.2 percent year-over-year increase. This is only moderately higher than the peak 3.6 percent year-over-year rate hit in February 2019. This means that if we are concerned about underlying inflation rather than supply shocks, most of the Fed’s work has been done.

Share of Unemployment Due to Voluntary Quits Edges Downward

The share of unemployment due to voluntary quits edged down to 12.8 percent. This is a sign that workers perceive they have less bargaining power. It peaked at 15.1 percent in February. It also reached levels above 15.0 percent just before the pandemic and in 2000. This is not a labor market in which workers feel totally comfortable quitting their jobs.

Hours are Also Stable

Earlier in the recovery, employers increased the length of the average workweek to a peak of 35 hours in January 2021 from a year-round average of 34.4 hours in 2019. This presumably was because of the difficulty in hiring workers. The average workweek has been at 34.6 hours for the last three months. This is consistent with a story where most employers are no longer experiencing much difficulty hiring workers.

The Slowdown in Wage Growth is Widespread

The fastest wage growth in the recovery has been at the lower end of the labor market, but the slowdown is showing up here as well. The annual rate for production and nonsupervisory workers was 5.1 percent, BUT was down from 6.5 percent year-over-year when comparing wage growth over the last three months with the prior three months. In hotels and restaurants it was 9.5 percent, down from 11.8 percent year-over-year.

Private Sector Nearly Back to Pre-Pandemic Employment Level

The private sector added 333,000 jobs in May, leaving it down by just 207,000 from its pre-pandemic level. It will likely cross this threshold in June.

Job Gains Widely Spread Across Sectors

Construction added 36,000 jobs in May, putting its employment 40,000 above the pre-pandemic level.

Manufacturing added 18,000 jobs in May, leaving its employment just 17,000 below the pre-pandemic level. Air transportation and trucking added 5,700 jobs and 13,300 jobs, respectively, in May, leaving employment in the sectors 6.3 percent and 4.3 percent above the pre-pandemic level.

Low Paying Nursing Homes and Childcare Centers Still Struggle to Find Workers

Nursing homes added 1,300 jobs in May, while childcare centers added 1,500 jobs. Employment in both sectors is still down more than 10 percent from pre-pandemic levels.

Leisure and Hospitality Sector Adds 84,000 Jobs

The leisure and hospitality sector was hardest hit by the pandemic closings. It is adding jobs at a rapid pace, but employment is still far below pre-pandemic levels. The arts and entertainment sector added 16,200 jobs, now down 211,000 jobs from the pre-pandemic level. Hotels and restaurants added 21,400 and 46,100 jobs, respectively. Employment in the sectors is now down by 383,000 and 751,000 jobs, respectively from pre-pandemic levels. It is worth noting that, despite the drop in employment, real restaurant sales are well above the pre-pandemic level.

State and Local Government Education Has Largest Job Gain in a Year

State and local government education added a total of 50,700 jobs in May. This is the largest gain since July 2021. Employment in public education is still 280,500 below its pre-pandemic level, as schools have had trouble attracting workers. The May jump is a big step towards reversing this shortfall.

Retail Sector Shows Big Job Losses in May

The retail sector lost 60,700 jobs in May, 32,700 of this loss was in general merchandise stores. This is consistent with reports of falling demand by Target, Amazon, and other major chains. With these chains reporting a glut of merchandise and loss of pricing power, we may soon see lower prices for many items.

Labor Force Participation Up for Prime Age Workers

The overall labor force participation rate edged up 0.1 percentage point to 62.3 percent, but the participation rate for prime-age workers (ages 25 to 54) rose 0.2 percentage point to 82.6 percent, 0.5 percentage points below the pre-pandemic peak but above the 2019 average. The rise was due to a 0.4 percentage point increase for prime-age women (the rate for men was unchanged) to 76.6 percent, a 0.3 percentage point below the pre-pandemic peak. Clearly, there has been no “great resignation.”

Self-Employment Rises in May

The number of both the incorporated and unincorporated self-employed rose in May. It now stands more than 1.1 million above its pre-pandemic level. Earlier in the recovery, it was plausible that many workers turned to self-employment because they were unable to get regular payroll employment; with the unemployment well under 4.0 percent, this is no longer the case. This jump in self-employment is by choice.

Another Very Positive Employment Report

The May employment report was just about as good as could have been hoped for. It continued to show strong job growth, but also a normalizing of the labor market that should allay concerns about the economy overheating and a wage-price spiral. Wage growth is clearly slowing, not accelerating as the wage-price spiral story would have it.

At the same time, most of the data look very similar to the strong pre-pandemic period. Most measures of employment and labor force participation rates are near pre-pandemic peaks and above 2019 averages. While payroll employment is still below the pre-pandemic level, it is important to remember that if we add in self-employment, current levels are considerably higher.

This first appeared on Dean Baker’s Beat the Press blog.