Stock bubble? What stock bubble?

As the Dow Jones edges closer to its October 9, 2007 closing high of 14,164, the mood on Wall Street has changed from cautious optimism to outright euphoria. Traders are now in seventh heaven as shares continue to charge upwards buoyed by weak earnings, slow growth, high unemployment, low capital investment, droopy consumer sentiment, chronic wage stagnation, widening inequality and, of course, boatloads of freshly-printed Central Bank money. The Fed’s radical monetary stimulus program, dubbed QE, has sent stocks into the stratosphere and chased the bears from downtown Manhattan. The bulls have returned to Wall Street once again, anticipating even bigger gains in 2013 . Here’s more from Bloomberg:

“International investors are the most bullish on stocks in at least 3 1/2 years, with close to two- thirds planning to raise their holdings of equities during the next six months, according to a Bloomberg survey….53 percent of respondents to the Bloomberg Global Poll also say equities will offer the highest return in the next year. That’s a 17 percentage point jump from the last poll in November and the most since the quarterly survey of investors, analysts and traders who subscribe to Bloomberg began in July 2009….

Equity market gains are expected to be widespread. More than three-in-five surveyed forecast the Standard & Poor’s 500 Index (SPX) and the MSCI Asia Pacific Index (MXAP) will be higher six months from now.” (“Investors Are Most Optimistic on Stocks in 3 1/2 Years”, Bloomberg)

Booyah, Ben Bernanke, investor class hero!

Stocks have been on a winning streak for so long, it’s hard to believe they’ll ever go down. The S&P has lunged ahead nearly 5% in the last three weeks alone, while the Dow has moved to within spitting range of its 2007 record-high as of Friday’s close. (13,896) Traders and fund managers are ecstatic, certain that 2013 will be another breakout year when the ocean of Fed-generated liquidity will converge with the torrent of capital fleeing the bond market pushing equities up, up, and away. According to USA Today “nearly $11 trillion in stock market wealth lost in the bear market has now been restored.” Money is flowing back into equities, optimism is on the rise, and Wall Street has regained its swagger. This is from CNBC:

“Market professionals, as measured by the Investors Intelligence survey of investors newsletters, are bullish by a 53.2 percent to 22.3 percent margin, the largest spread in four months. The last time the gap was this big preceded a 7 percent market drop in a month, which in turn preceded the current rally….

…The more than 470 days the market has gone without a correction – or 10 percent market drop – marks the 10th longest such streak in market history and the best run since the record 2,553 days that lasted from 1990-97. Three-quarters of the Standard & Poor’s 500 stocks are in overbought territory, according to Bespoke Investment Group.

“If the market keeps moving higher, not worrying about anything, it’s going to be difficult for the bulls,” said Quincy Krosby, chief market strategist at Prudential Annuity. “The market’s not climbing a wall of worry – it’s not worrying about anything. Typically when that happens something will come along to pull it back.” (“Bears on the Brink: ‘I Can’t Fight It Anymore'”, CNBC)

Krosby’s just a worrywart. What does he know? This market is headed for the moon. Nothing’s going to stop this juggernaut. The Dow’s probably going to cross 30,000 before it even takes a breather. Hasn’t Krosby been reading the New York Times lately? Things are so bright, they need sunglasses! This is from the NYT:

“Americans seem to be falling in love with stocks again. Millions of people all but abandoned the market after the 2008 financial crisis, but now individual investors are pouring more money than they have in years into stock mutual funds. The flood, prompted by fading economic threats and better news on housing and jobs, has helped propel the broad market to within striking distance of its highest nominal level ever.

“You’ve got a real sea change in investor outlook,” said Andrew Wilkinson, the chief economic strategist at Miller Tabak Associates…

As the fog of crisis has cleared, investors have more clearly focused on the cascade of good economic data pointing to a growing housing market, shrinking unemployment and corporate earnings that were stronger than expected.” (“As Worries Ebb, Small Investors Propel Markets”, New York Times)

It all sounds so rosy, doesn’t it? And if you can’t trust the paper of record, then who can you trust? It’s not like they’ve ever lied about anything before, right–like mobile weapons labs, or imaginary WMD or anything like that? It’s too bad the Gray Lady’s story doesn’t square with what we’ve been reading in the Associated Press. There appears to be a slight discrepancy in their analysis. See if you can see the difference.

“Defying decades of investment history, ordinary Americans are selling stocks for a fifth year in a row. The selling has not let up despite unprecedented measures by the Federal Reserve to persuade people to buy and the come-hither allure of a levitating market. Stock prices have doubled from March 2009, their low point during the Great Recession.

It’s the first time ordinary folks have sold during a sustained bull market since relevant records were first kept during World War II, an examination by The Associated Press has found. The AP analyzed money flowing into and out of stock funds of all kinds, including relatively new exchange-traded funds, which investors like because of their low fees.

“People don’t trust the market anymore,” says financial historian Charles Geisst of Manhattan College. He says a “crisis of confidence” similar to one after the Crash of 1929 will keep people away from stocks for a generation or more.”….

Since they started selling in April 2007, eight months before the start of the Great Recession, individual investors have pulled at least $380 billion from U.S. stock funds, a category that includes both mutual funds and exchange-traded funds, according to estimates by the AP. That is the equivalent of all the money they put into the market in the previous five years.” (“AP IMPACT: Ordinary folks losing faith in stocks”, AP News)

Well, that doesn’t sound very encouraging, does it? Nor does the fact that (according to blogger Sober Look) “Global Risk Appetite index continues to march higher as investors embrace the “risk-on” trade….Other risk indicators also show a similar trend. VIX for example is at new post-recession lows…Junk bond yields hit another all-time low yesterday and Eurozone periphery debt yields hover near recent lows as well.” (“Risk appetite hits new highs”, Sober Look)

What does that mean? It means that there are signs of “frothiness” and complacency everywhere, but investors are still getting back into the market because they think the Fed will put a floor under any correction by printing more funny money to keep stocks artificially high. And, maybe they’re right, after all, what could go wrong?

Well, for one thing, Congress could blow up the economy by trying to reduce the budget deficit prematurely. Here’s the scoop from Andrew Fieldhouse at the EPI:

“Congress predictably failed to adequately moderate the pace of deficit reduction; short of sharply reorienting fiscal policy to accommodate accelerated recovery, U.S. trend economic growth will continue decelerating into 2013—slowing to anemic growth insufficient to keep the labor market just treading water. Absent substantial additional spending on public investment and transfer payments, the labor market will almost certainly deteriorate this year, regardless of what happens with sequestration and the pending debt ceiling fight….And this budget deal—indeed expiration of the payroll tax cut alone—guarantees that current economic performance will not be sustained…

First and foremost, the expiration of the payroll tax cut is projected to reduce disposable income by $115 billion, shaving 0.9 percentage points from real GDP growth and lowering employment by nearly 1.1 million jobs relative to 2012 fiscal policy…Even if the sequester is fully repealed without offsets…real GDP growth of roughly 1.6 percent would be expected.” (“At best, budget deal suggests decelerating anemic growth, labor market deterioration”, Andrew Fieldhouse, EPI)

That’s a long-winded way of saying that austerity is going to shrink the economy, but that’s what it amounts to. Keep in mind, the US economy is already running $1 trillion per year below potential output. The upcoming budget deal, is only going to make things worse. (“The CBO’s current economic forecast indicates a decade-long economic slump, in which the United States will forgo $8.1 trillion of national income.” EPI)

So, do you you really think Bernanke will be able to keep the rally going in the face of rising unemployment, sputtering activity, and slower growth?

Dream on. Keep in mind, that the recovery is already the weakest on record, and that (according to Gallup) Americans are more negative about the economy in any time in the last 30 years, and that earnings (while meeting analysts expectations “low” expectations) have slipped dramatically, and that the Fed’s QE program is already showing signs of diminishing returns.

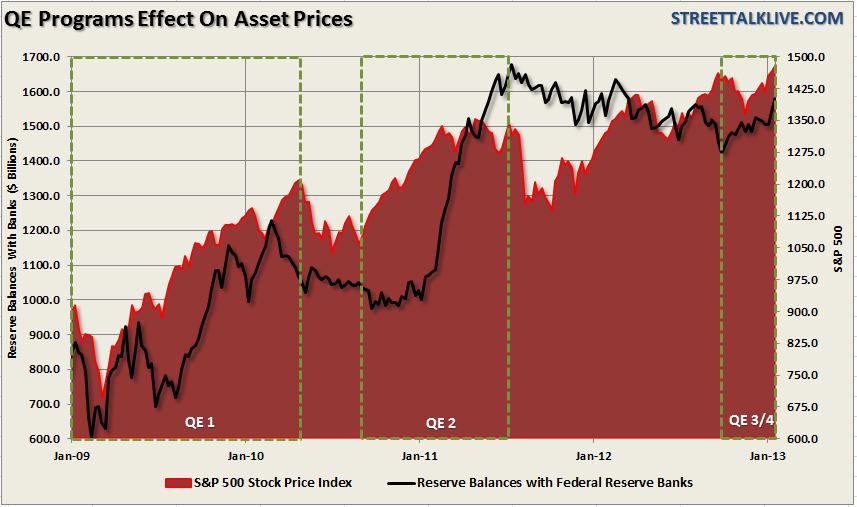

None of this bodes well for stocks which have remained airborne due entirely to the $85 billion per month liquidity injections from the Fed via QE. As analyst Lance Roberts points out in a recent post: “There is a very high historical correlation (85%) between the expansion of the Fed’s balance sheet and the stock market.”

You bet, there is, and it’s easy to see in this chart that Roberts inserts into his post at dshort.com.

Here’s more from Roberts:

“It is clear that the visible hand of the Federal Reserve is firmly in control of the markets at the moment as liquidity flows are increased. However, extrapolating the current advance indefinitely into the future becomes somewhat dangerous. Each previous program cycle has ended with a fairly nasty decline, in both the markets and the economy, as the fundamental drivers were being supported solely by artificial interventions. Those declines would have likely been far worse had they not been halted by the next round of “liquidity injected goodness…” (“The Visible Hand of the Fed”, Lance Roberts, dshort.com)

Anyone who’s seriously thinking about getting back into the market, should spend a little time reviewing Robert’s chart. It shows pretty clearly that all of the so called “rallies” of the last 4 years have been the result of the Fed’s interventionist hanky panky. That’s doesn’t mean that the current rally couldn’t last a while longer. It could. In fact, Bernanke’s going to do everything he can to make sure that it does! But, then what? I mean, we already know how this ends, right? Or have you forgotten already?

MIKE WHITNEY lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.