Over the past three decades, income inequality has risen in most of the 34 member countries of the Organization for Economic Cooperation and Development. A recent analysis of 22 OECD countries from 1985 to 2013 found that inequality increased in 17 of them (including the US, UK, Canada and Germany), underwent little change in four (Belgium, Netherlands, France, Greece) and declined in only one (Turkey). Over the same period, in the 17 richest countries GDP growth primarily benefitted the top 10% of the population, with the bottom 40% receiving little from a quarter century of growth.

The prevailing explanation for rising inequality – the mainstream economics explanation – is that technology did it. There are no capitalists making investment decisions, no managers making employment decisions and certainly no class struggle. Only technical change, supply and demand. Here I want to make the case for the centrality of class struggle in driving inequality.

According to Harvard economist N. Gregory Mankiw, “Most economists agree that a leading cause [of rising inequality] is skill-biased technological change — the tendency of new technologies to increase the relative demand for skilled workers.”

A more sophisticated and convincing version of the technology story is the “task approach” of MIT economist David Autor and colleagues, which is about the automation of jobs. Computerization is able to easily replace routine jobs, which happen to be those in the middle of the skill distribution (e.g. clerical work and bookkeeping). Both higher-skill jobs (e.g. professionals, managers and technical workers) and lower-skill jobs (e.g. cooks and cleaners) are nonroutine jobs, hence unable to be replaced by automation.

The task version of the technology story well fits the data showing polarization of the job structure into high-wage and low-wage jobs, and it is an important part of the story. But it’s not the most important part of the story.

If technical change is the main driver of income inequality, then either version of the technology explanation predicts that inequality should trend similarly in countries that are comparable in terms of level of economic development, industrial structure and vocational training and educational systems.

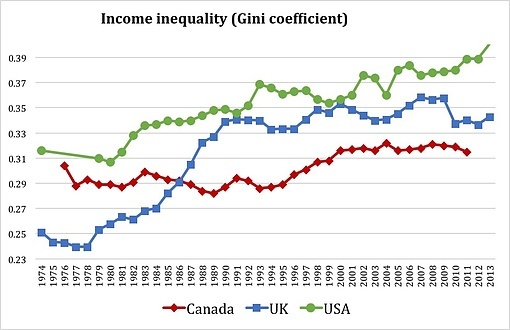

To examine this, I’ve plotted income inequality for Canada, the UK and the USA. In addition to having similar industrial structures, these countries are all conventionally understood to be institutionally similar, highly liberal economies with minimal government intervention and only a residual social safety net. Further, they have comparable vocational training and education systems with similar outcomes on a range of indicators.

As a measure of inequality I used the Gini coefficient, in which perfect equality has a value of zero (0) and complete inequality a value of one (1). Using OECD data, the only measure available for all three countries going back to the early 1970s is the Gini for net income (after taxes and transfers). The Gini for gross income would have been better, because it would display the picture produced before government transfers. However, all three countries have similar levels of government income transfers, so the net income measure will suffice.

Source: OECD (Canada and US) and Institute for Fiscal Studies (UK).

The trends in the chart are not easily squared with the prediction of the technology story. From the early 1970s to the present, income inequality has risen more or less continuously in the US, while in Canada it was stable for two decades until around 1994, rising continuously thereafter. In the UK inequality rose faster than the US until 1990, thereafter remaining comparatively stable while it continue to rise in the US.

In a bit more detail, in Canada the trend in inequality was largely flat for 21 years, fluctuating only 0.019 points between from 1976 to 1997. Over the same period, inequality in the US rose more or less continuously, a full 0.062 points. In the UK, inequality rose even faster than in the US in shorter period of time: shooting up 0.101 points in just 13 years between 1978 and 1991.

Compared with Canada, variation from low point to high point in the Gini coefficient over the 21 years from 1976 to 1997 was three times higher in the US and five times higher in the UK.

A more plausible explanation for the variation in income inequality trends across the OECD would refer to the distinct political economy of each country. Because such an explanation requires an in-depth analysis of each country, I focus the remainder of this short article elaborating a class struggle argument for the US case.

The skill-biased technical change story is an extension of human capital theory. According to the latter, wages are determined by the skill levels of individual workers; according to the former, technology increases the productivity of skilled workers, hence increasing demand for them. Human capital theory suggests the rise in low-wage jobs would be driven by a rise in low-skill jobs. However, in a recent academic paper I found that from 1960 to 2005, there was a 15 percent decrease in the low-skill job share of total employment.

In short, compared with previous decades, the contemporary American economy has a lower proportion of low-skill jobs yet a higher proportion of low-wage jobs. What gives?

The US Case

A high corporate profit rate in the 1950s and ‘60s allowed a class compromise: Capital provided secure jobs, rising real wages and opportunities for training and promotion; labor provided industrial peace and cooperation with management leading to continuous productivity improvements. The class compromise was forged within the corporation.

Sociologists have shown that there is no single version of economic rationality. Rather, people come to understand their interests through particular ideologies or cultural logics. In the 1950s and ‘60s, corporate managers understood their business interests to include not simply maximizing shareholder value but also sales growth and market share. The dominant logic of corporate organization was one of vertical integration.

The logic of vertical integration included internalizing employment: the development of internal labor markets and the protection of workers from market forces. As a result, many low-skill jobs in large manufacturing corporations provided security, opportunities for training and promotion, and decent pay through administratively-determined wages (patterned on union contracts in the auto sector).

Vertical integration led to high levels of industry concentration. It has been demonstrated that industry concentration ratios have a remarkably strong negative correlation within inequality, a full –0.8 in the US from 1950 to 2006. Inequality is reduced by high concentration due to the substitution of administrative policies regarding wages for market determination.

However, the profit rate began dropping due to a combination of increasing capital intensity in the economy (pushing the profit rate down) and increasingly high wages associated with the class compromise (cutting into the profit rate). From a postwar high of 26.8 percent in 1951 the corporate profit rate dropped to a low of 9.4 percent in 1982.

Source: BEA data (corporate profit/corporate net capital stock).

Under intensified international competition and a declining profit rate, capital abandoned the class compromise and began to recover profits out of wages.

One of the most well-known outcomes of capital’s assault on labor was deunionization, which played a central role in rising inequality, the former explaining up to one-fifth of the latter in the US.

Equally important, under the rise of the ideology of shareholder value, the dominant logic of employment became one of externalization. This included outsourcing, downsizing, and lean staffing strategies (which reduced opportunities for training and promotion) along with increased use of part-time and temporary employment.

Most important was a return to the market-determination of wages even for full-time, long-term jobs. This provides an explanation for the increase in low-wage work despite a decrease in low-skill work: under the class compromise, low-skill jobs provided decent wages because they were shielded form market forces. Under the ideology of shareholder value and the logic of employment externalization, market competition now forces the wages of low-skill workers down as far as possible.

A central outcome of these measures has been a steady decline in the wage share of total national GDP (leading to a rise in the profit share) from a high of 59.9 percent in 1970 to just 50.7 percent in 2011. This is behind the partial recovery of the profit rate.

In sum, much of the rise in inequality is the result of class struggle, as capitalists and their managers have attempted to recover profits out of wages. This happens through real people making real decisions – what industries and regions to invest in, how to organize the corporation, how to structure employment contracts – not by the impersonal march of technology.

To be sure, there are structural dynamics driving these decisions – the UK and Canada experienced similar declines and rises in profit rates and employment costs, and engaged in similar responses, though with different timings and magnitudes. Nonetheless, it remains the case the decisions of a small class of capitalists are behind rising inequality and stagnating living standards.