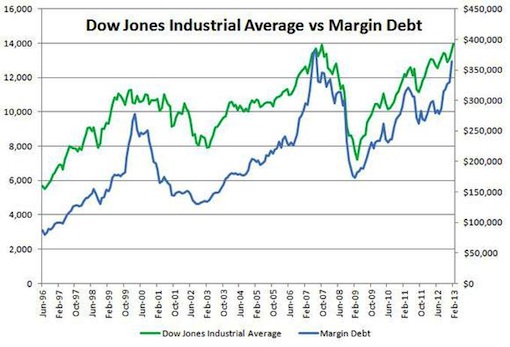

Investors have boosted their borrowing to near-record levels to load up on stocks. The last time that margin debt was this high was just before the bubble burst in 2007. In January, New York Stock Exchange (NYSE) margin debt tipped $366 billion, just shy of the 2007 peak of $380 billion. The Fed’s zero rates and $85 billion per month bond buying program (QE) have sparked the same irrational exuberance that preceded the Crash of ’08. Investors are piling on the leverage because they feel confident that Fed chairman Ben Bernanke will not allow markets to fall too sharply. (This is called the Bernanke Put) This week’s see-sawing markets suggest that QE’s impact may be wearing off. Deflationary pressures are building in the real economy at home and abroad. As these pressures intensify, stocks will retreat forcing deeply-leveraged investors to exit their positions which will accelerate the pace of decline.

Sources: NYSEData.com Facts & Figures, St. Louis Federal Reserve.

As you can see from the above chart, the rise in stock prices is nearly identical to the rise in margin debt. The Fed’s easing strategies have increased risk appetite while contributing little to the real economy. This phenom runs counter to the Fed’s mandate which is “price stability and full employment.” In truth, the Fed is adding to systemic instability by suppressing rates and forcing investors to take on more risk than they should. Last week, in a speech delivered to the IMF, Federal Reserve vice chair Janet Yellen refuted this charge claiming that Fed policy reduces risky behavior. Here’s a short excerpt from her speech:

“Some have asked whether the extraordinary accommodation being provided in response to the financial crisis may itself tend to generate new financial stability risks. This is a very important question. To put it in context, let’s remember that the Federal Reserve’s policies are intended to promote a return to prudent risk-taking, reflecting a normalization of credit markets that is essential to a healthy economy.

…Obviously, risk-taking can go too far. Low interest rates may induce investors to take on too much leverage and reach too aggressively for yield. I don’t see pervasive evidence of rapid credit growth, a marked buildup in leverage, or significant asset bubbles that would threaten financial stability.”

This is nonsense. There are signs of Fed-generated bubbles everywhere not just in stocks. Take a look at this from Bloomberg’s Lisa Abramowicz on the boom in junk bonds:

“Investors are favoring the riskiest, hardest-to-trade junk bonds by the most in 17 months as confidence mounts that central banks from Japan to the U.S. will prop up debt markets through year-end.

The extra yield investors demand to buy the least-traded bonds with the lowest speculative-grade ratings instead of more liquid securities narrowed to 1.2 percentage points on April 9, the smallest gap since November 2011, according to Barclays Plc (BARC) data. Yields on the smallest and oldest CCC rated notes contracted by 1.9 percentage points this year, three times the drop on yields for more active notes with comparable grades.

Bond buyers seeking to escape the financial repression brought on by near zero interest rates are venturing deeper into the market in search of returns. They are bidding up the debt of companies that would otherwise be the most vulnerable to bankruptcy had the Federal Reserve not injected more than $2.3 trillion into the financial system since 2008.”

So, there’s a gold rush in junk bonds?

You bet, but Yellen says not to worry.

Naturally, if the Fed pegs the price of money at zero, then proceeds to flood the financial markets with trillions of dollars in liquidity, bubbles are going to emerge. Yellen’s denial should merely be seen as proof that the policy is achieving it’s intended goal which is to create a bifurcated economy where bankers and other speculators make off like bandits while working people face high unemployment, falling wages and sharp cutbacks to public services.

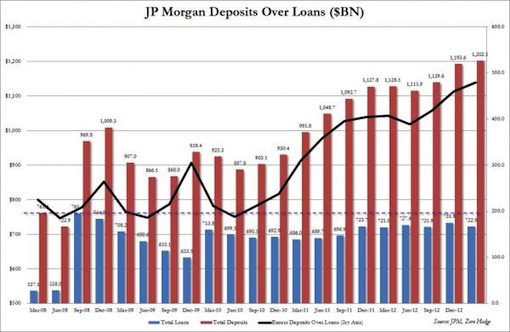

Despite the obvious dangers to the economy, Bernanke plans to stick with QE until unemployment drops to 6.5% or inflation rises above 2.5%. But those benchmarks will be hard to achieve with trillions in reserves stuck in the banking system unable to “trickle down” to the real economy. The basic problem is easy to understand: When the demand for funds is weak– as it is during the current deleveraging supercycle–credit cannot expand. And, when credit doesn’t expand, the economy doesn’t grow, unemployment doesn’t drop, and the recovery doesn’t strengthen. Here’s a chart from zero hedge which illustrates how Bernanke’s policies have failed to “get the banks lending again”.

“It is a very simple chart – it shows total JPMorgan deposits, loans and the excess difference of deposits over loans.

Why is it a good summary? Because as the blue bar shows, total loans issued by the biggest US bank were $723 billion in Q1 2013: about $30 billion less than in the quarter Lehman blew up. Four years later, and the US commercial bank lending apparatus is still in a state of depression. Or so it would appear on the books.

“…By keeping the pedal to the metal on QE, the Fed is giving the banks all the benefits of money creation (soaring deposits), without any of the risks (loan creation in a record low interest environment).

QE has not increased lending, not led to a credit expansion, and not reduced unemployment. It has created an equities bubble, a bond market bubble, and distorted asset prices across the board. As Pimco’s Mohamed El-Erian said in a Bloomberg interview earlier in the week, “Virtually every market is trading at artificial levels” while investors are “taking more risk than is justified.”

Central bank policy has pushed stock prices higher, but it’s also created the conditions for another disaster.

MIKE WHITNEY lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. Whitney’s story on Bernanke’s Subprime Bonanza appears in the April issue of CounterPunch magazine. He can be reached at fergiewhitney@msn.com.